Would you rather have a dollar today or a dollar tomorrow? What about one dollar every month or twelve dollars at the end of the year? The majority of us would take the money as soon as possible. This is based on two old economic principles; opportunity cost and the time value of money. We know that having a dollar today rather than some time in the future is more valuable because it means we can use that dollar immediately. This could mean saving, paying off debt, or even investing it for the future. Therefore, as we evaluate something of equal value received in the future, we discount its worth and prefer that same value now. This is relevant to us as taxpayers as every month we are given the option to receive more now or more when we file our taxes (assuming we are withholding too much). And while its obvious to us to take the dollar today versus tomorrow, a 2011 study found that the average federal refund in the state of Wisconsin was $2,462.89. We are no longer talking about a dollar every month but rather $205! That’s a meaningful difference and one that we should not quickly ignore. Sizable tax refunds can be used for good things like paying off debt or saving. But more often than not they are used for less noble options, despite our best intentions. What then can we do to remedy the situation and get funds back in our monthly budget?

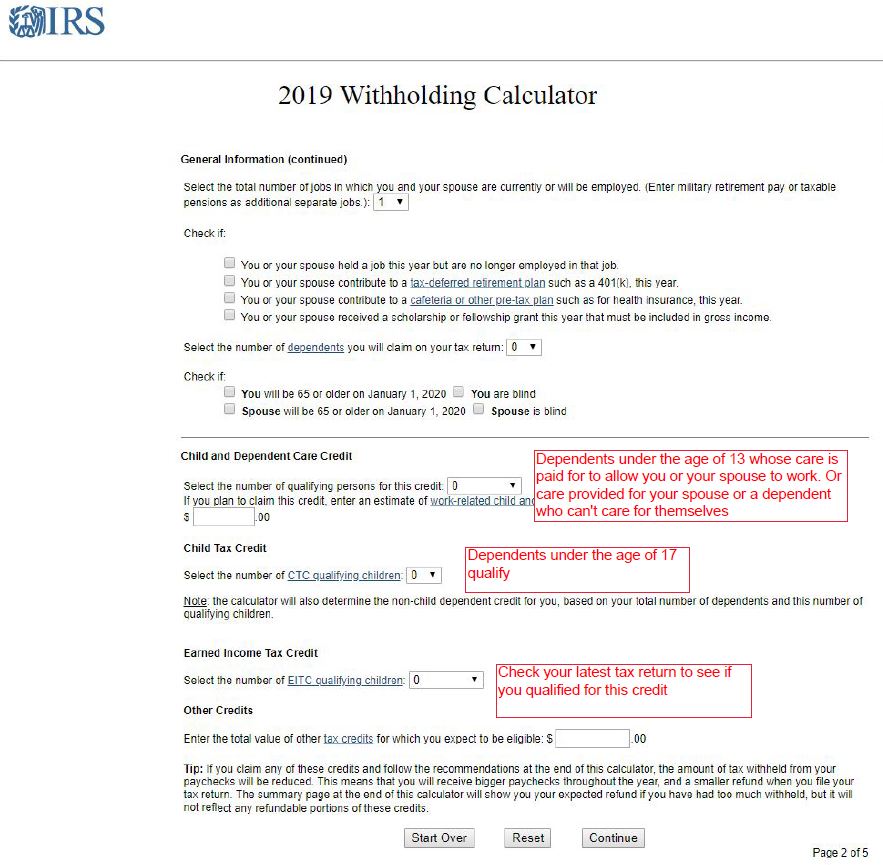

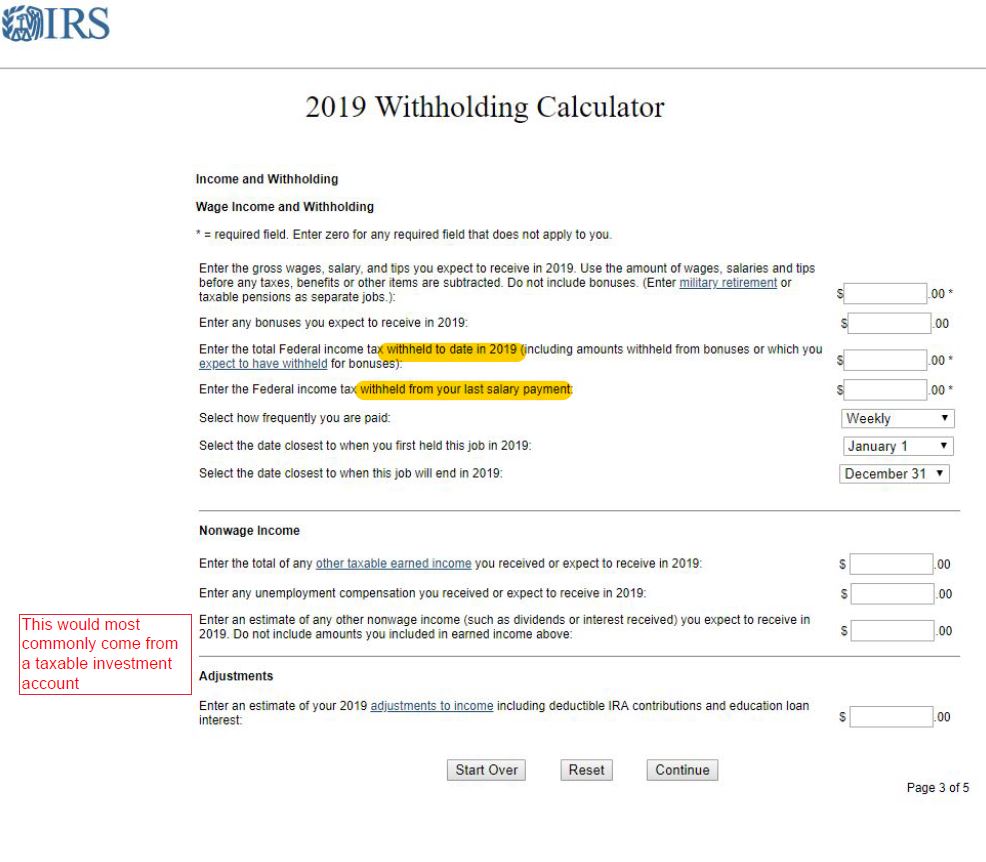

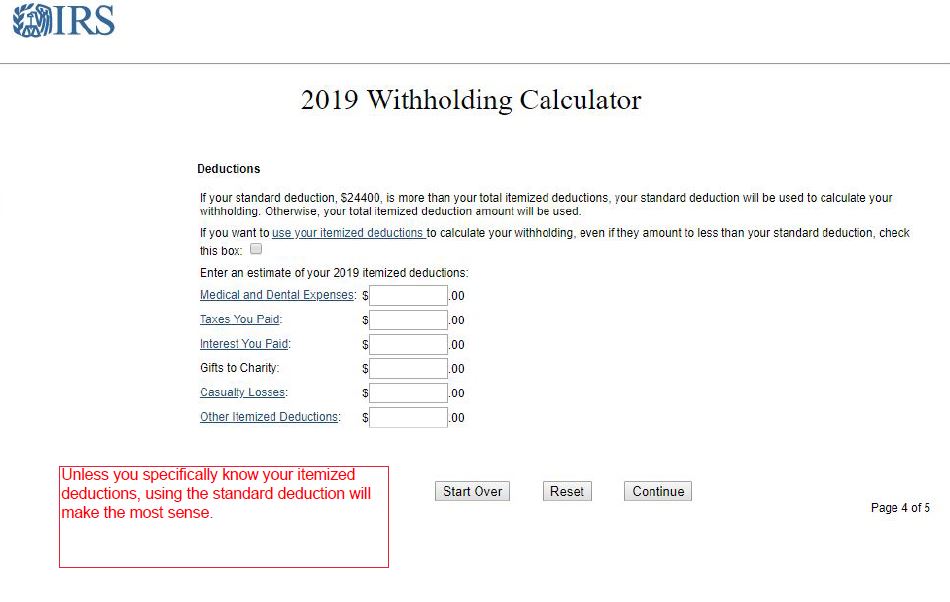

There are a couple of ways to make sure your withholding is as accurate as it can be. The first step is to visit the IRS’s Withholding Calculator. You will need annual income figures, a copy of a your most recent pay stub(s), how much in taxes you have paid so far in the given tax year, and your portion of employer sponsored plan contributions (401(k) 403(b) etc..). The calculator works best if your situation is relatively simple, one or two incomes along with only a few dependents. However, if your situation is more detailed than that, you can still get a good reading from the calculator but having all the relevant figures will be even more important. See the screenshots for more tips when filling out the calculator.

Once you have completed the calculator, you will have a good reading of where you stand for the given tax year. The next task is to complete the IRS’s W-4 worksheet. This is a somewhat duplicative job, but it is also a good proof of your work as it should result in the same recommended allowances as the calculator. If you have a dual income household, make sure you also complete the two earners worksheet on page 4. The end result of completing the W-4 and withholding calculator may mean you need to modify you existing allowances. You will need to work with your employer to adjust the number of allowances you claim. This figure comes from page 1 of the W-4 (see W-4 screenshot below). Some employers may require you to sign and submit this completed W-4 while others are able to make the change without it.

After you have worked with your employer to update your allowances, it’s important to allow 1 or 2 paychecks to flow through the updated withholding. This will produce new figures for how much is taken out of each paycheck for taxes. With these new figures in hand review your work once again. This can be done by redoing the withholding calculator based on the amounts withheld from your latest paycheck and the new amount withheld year to date (see withholding calculator page 3). You can also check your work by extrapolating one month’s withholding into twelve and checking the final figure with your previous year’s taxes paid (make sure to take into account any increase or decrease in earnings as well as fluctuations in pay from month to month, if your compensation is not level). Based on the results of this final check, you can either revise your allowances by repeating the prior steps or continue to withhold at the new amount, if the numbers are correct. By knowing these numbers, you will have a better feel for how your taxes will shake out for the following year. Tax withholding is not an exact science and everyone’s situation is unique. This may mean having to dreadfully “pay in”. But if you can see it coming, hopefully you will be more prepared.

So why go through all of the work if you are going to get the money at the end of the year anyway? I alluded to this point in the opening paragraph. Monthly cash flow is the basis upon which most of us budget and how we direct normal spending. To have the most effective and efficient budget, we need to correctly account for tax withholding. Let’s use the above-mentioned average as an example. If we received $205/mo. and applied that to debt reduction (assuming a $10,000 balance, interest rate of 5%, and a 5-year period) we would be able to pay the loan off almost 6 months earlier when compared to using the same dollar amount but only once per year. And while it’s also true that you are making an “interest free loan to the government” by over withholding, proper tax withholding is less about them and more about you. “With great power comes great responsibility”. Adding these funds back into your monthly budget will mean that every month you will need to be disciplined to make sure that money goes towards its intended purpose.

If you think that this is just too much work, the good news is the IRS has done some of this work for you. A couple articles have run in the last few weeks reporting that Americans are receiving smaller refunds for 2018 compared to previous years. Here is an example from CNBC “Here’s why the average tax refund check is down 16% from last year”. As the article points out, this had been due in part to the fact that Americans are receiving more in wages on a monthly basis and less at the end of the year from a tax refund. This is good news for all of us! It means the IRS has already done a better job of estimating our taxes based on the tax law changes enacted in 2017. While this is a good start, I would still encourage you to look at your own withholding and do the work to see if any changes need to be made.

Andrew Froelich

Financial Advisor

https://www.governing.com/gov-data/finance/average-irs-tax-refund.html

https://www.cnbc.com/2019/02/22/heres-why-your-tax-refund-could-be-smaller-than-last-year.html

While we are familiar with the tax provisions of the issues presented herein, as Financial Advisors of RJFS, we are not qualified to render advice on tax or legal matters. You should discuss tax or legal matters with the appropriate professional. Any examples are hypothetical and for illustration purposes only. Actual results will vary.