The Client Experience

“What are the steps to get started and what can I expect?”

Click through the process below to learn more

Step 1 - introduction & discovery

+ Getting to Know You

Prior to our first Discovery meeting, we will send you a link to our Getting to Know You Questionnaire, a list of common information and documents to gather, as well as a link to our Secure File Uploader. The more of it you can finish in advance, the better prepared we are for a more effective meeting.

+ 60-90 Minute Discovery Meeting

This is first and foremost about your story, goals, challenges and resources. We will also share our Client Relationship Summary, which clarifies our services and answer questions you might have about what happens next. Here you will probably decide if you believe we will add value to your life, if you feel comfortable with our approach, and if you like us personally.

step 2 - Strategy & Collaboration

+ Draft Initial Financial Plan

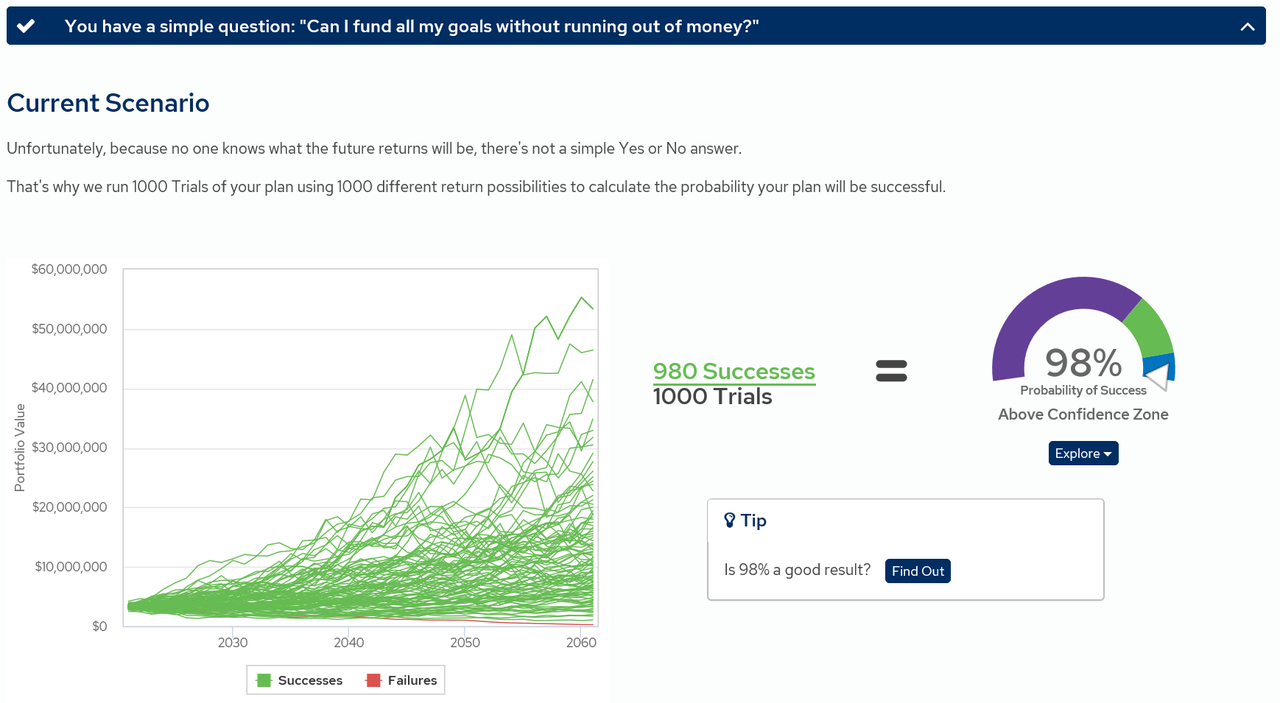

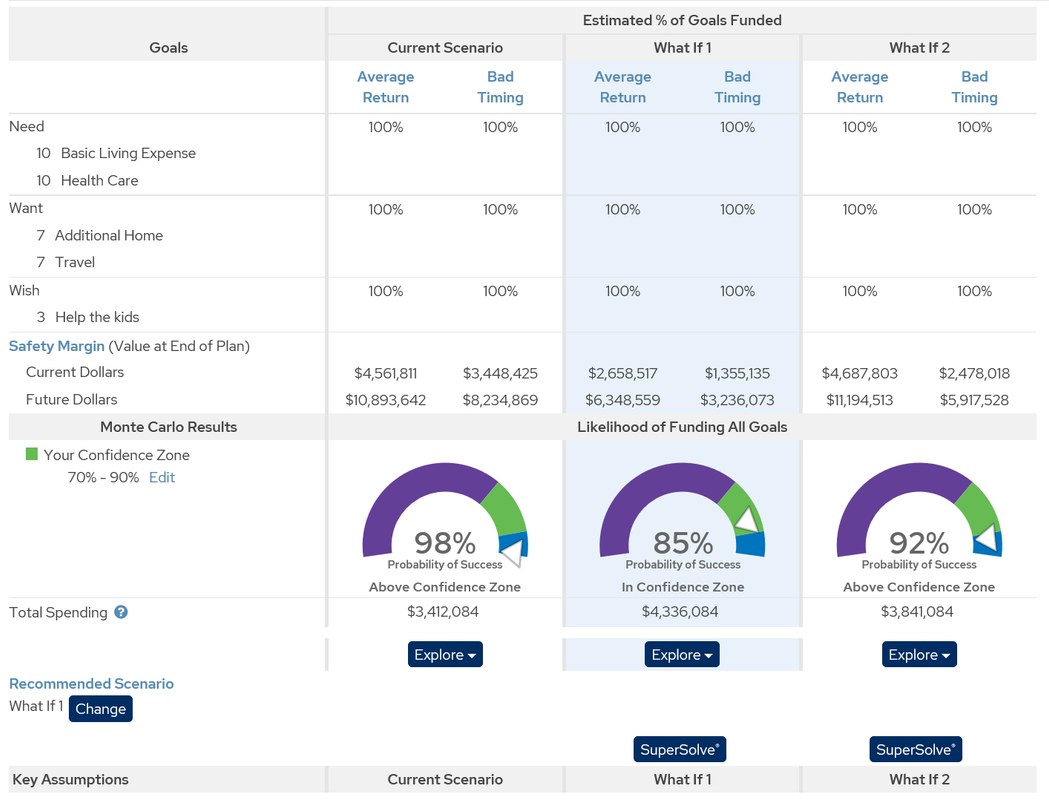

Goal Planning & Monitoring Sample Scenario

Multiple Strategy Planning Scenario Outcomes

+ 90 MINUTE COLLABORATIVE STRATEGY MEETING

This is our favorite meeting. We will take you through the important assumptions and inputs to the first draft of your financial plan, and explain our thoughts in plain English. We’ll encourage your feedback, make immediate adjustments, and create new scenarios for you to consider. The result will be an agreed upon strategy that will inform nearly all of our planning and investment recommendations going forward.

step 3 - Recommendations

+ 45-60 Minute Recommendation Meeting

Here we will share our planning and investment recommendations, in the context of your overall strategy. Together we will agree to the recommendations themselves, as well as establish a timeline for implementing the various planning and investment recommendations.

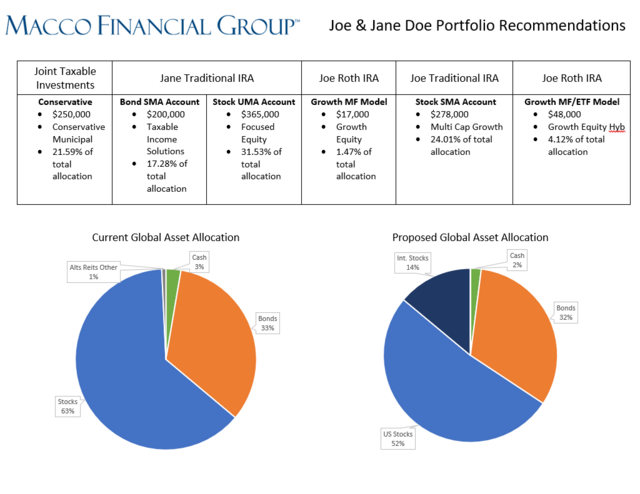

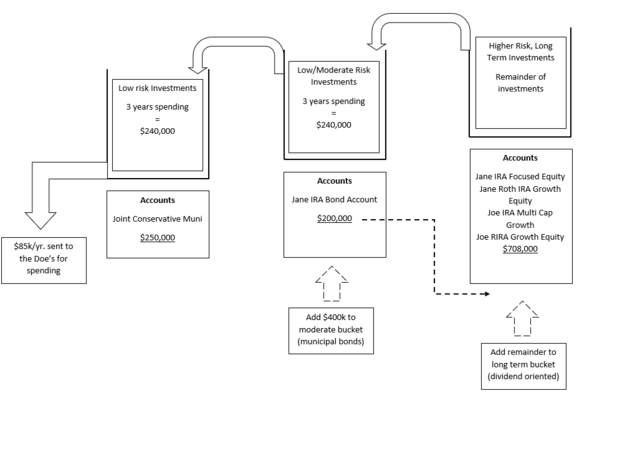

+ Recommendations

Planning Recommendations often relate to the following: investment and retirement contribution types and amounts, short term and long term tax efficiency planning, cash flow and debt coordination, insurance recommendations, and legal planning*.

Investment Recommendations are specific to the role we are asking each investment account to play within your overall strategy. We will cover appropriate details of each investment, including allocations, contributions, tax efficiency, risk/return objectives, and coordination between accounts*.

Step 4 - Implementation & follow up

+ Execute on Your Planning Actions

We will guide you through whatever steps are needed. The time and effort involved can vary widely depending on the specific recommendation(s).

+ Execute on Your Investment Actions

For investment recommendations, we often need to open accounts and initiate the transfer of assets. Some can be transferred by simple signatures, others require 10-15 minute phone calls or company specific forms. Either way, the process is easy and our team will the leg work. Once the assets arrive, we will implement the investment recommendations.

+ Account Transition Review

It’s normal to meet again to review transitioned accounts, making sure the result is what we intended, and do minor course corrections if appropriate. It’s common to do an overview of Raymond James Client Access, our online client portal, and your first statements.

Get Started!

Schedule a 15 minute phone call with us to get started.

Video walk-through

Watch the video below to learn more about the Client Experience